ADA, the native token of the Cardano blockchain, appears to be struggling to maintain a crucial support level amid market uncertainty. Today, December 27, 2024, the overall cryptocurrency market sentiment appears to be witnessing a decline in prices, including major assets such as Bitcoin (BTC), Ethereum (ETH), and XRP.

This decline in major asset prices has shifted the entire market sentiment towards the downside.

Cardano (ADA) current momentum

At press time, ADA is trading near $0.864, having seen a price decline of more than 6.9% over the past 24 hours. Amid this price decline, the altcoin has reached a critical level. If this level fails to hold, the asset could fall by 15%, falling below the $0.75 mark.

The downward price movement has sparked fear among traders and investors, resulting in lower trading volume. According to CoinMarketCap data, ADA trading volume decreased by 16% in the past 24 hours.

Cardano (ADA) Technical Analysis and the Next Level

According to expert technical analysis, ADA has recently broken out of a bearish head and shoulders price action pattern. Over the past seven days, the price has been consolidating below the neckline of the pattern. Amid the recent price decline, the price of ADA has reached the lower limit of the consolidation zone and is about to collapse.

Based on the recent price action, if the altcoin breaks through this level and closes a daily candle below the lower bound of the area, there is a strong possibility that it will fall by 15%, reaching the $0.77 mark in the future.

The bearish ADA hypothesis will only be valid if a daily candle closes below the $0.85 level, which forms the lower bound of the consolidation zone. Otherwise, the bearish scenario may fail to materialize.

The scales on the string reveal mixed feelings

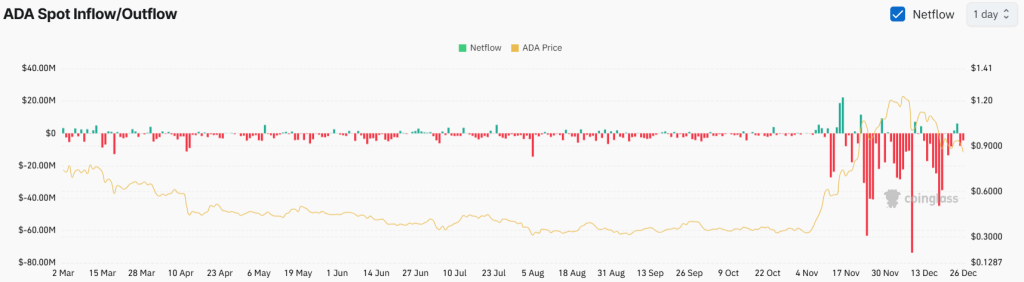

Despite this bearish outlook, long-term holders appear optimistic, while traders appear hesitant to create new positions, the on-chain analytics firm reported. Quinglass. Data from ADA Spot Inflow/Outflow reveals that exchanges saw a significant outflow of $4.7 million from ADA, indicating potential accumulation and buying pressure.

Conversely, traders appear to be liquidating their positions, as evidenced by the 8.2% drop in ADA open interest over the past 24 hours.